Tag: home buyer

House prices expected to drop in 2017

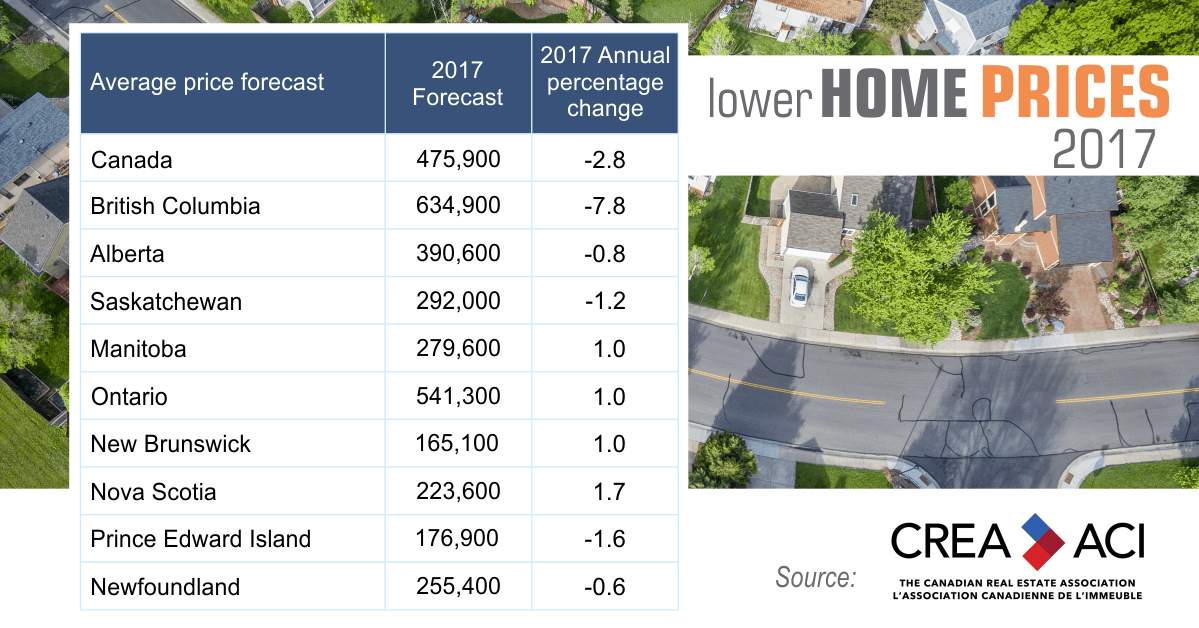

By: igillCanadian realtors are forecasting a price drop across Canada for the first time since 2008. They blame the new mortgage regulations brought in by the federal government in the last quarter of 2016.