Tag: home prices

House prices expected to drop in 2017

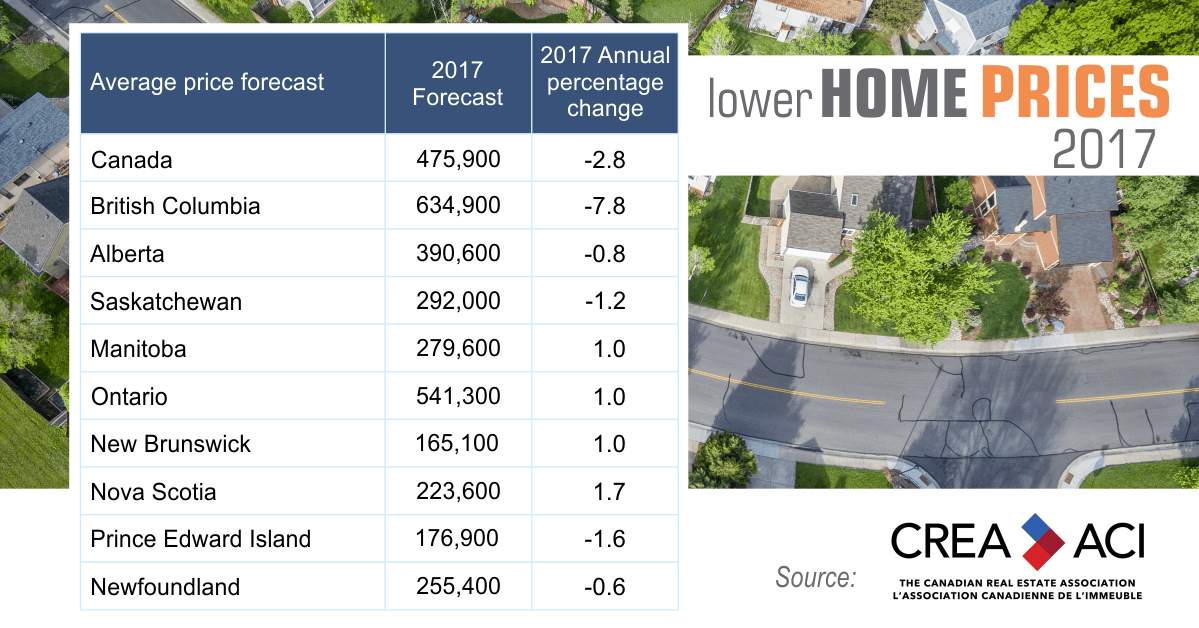

By: igillCanadian realtors are forecasting a price drop across Canada for the first time since 2008. They blame the new mortgage regulations brought in by the federal government in the last quarter of 2016.

Calgarians Rank City Housing C+, Neighbourhoods B-

By: Elias KellendonkRecent Survey Finds Vast Majority of Calgarians are Happy – and Satisfied with Financial Well Being The Calgary Foundation released its 2011 Vital Signs this week, an ‘annual community checkup that measures the vitality of the community, identifies significant trends, and assigns grades in 12 areas critical to quality of life.’ According to the 2011 …