Topic: Financial Planning

Over Half of Canadian Retirees Are in Debt, but That Doesn’t Have to Include You

By: Elias KellendonkA recent poll done by CIBC and Harris/Decima has found that 59% of Canadian retirees are still in debt. Worse yet, the poll finds that 55% of people that carry debt into retirement have seen their debt levels either increase or remain unchanged over the past year. As you can imagine, it only becomes more …

How to Compost

By: Elias KellendonkMake your Backyard Greener Composting is an easy, inexpensive way to ensure your planting soil is getting the nutrients it needs. Compost and leave and grass mulches improve soil texture, prevent erosion, better hold moisture and encourage healthy plant growth. A healthy yard often means a healthy home – less opportunities for water to seep …

Calgarians Rank City Housing C+, Neighbourhoods B-

By: Elias KellendonkRecent Survey Finds Vast Majority of Calgarians are Happy – and Satisfied with Financial Well Being The Calgary Foundation released its 2011 Vital Signs this week, an ‘annual community checkup that measures the vitality of the community, identifies significant trends, and assigns grades in 12 areas critical to quality of life.’ According to the 2011 …

Wall Street: From New Amsterdam to this Quarter’s Close

By: Elias KellendonkFor more than 400 years Manhattan has been the site of big trades, big gains and big losses. The island was originally purchased in 1626 from the Lenape Native Americans for a sum of 60 Dutch guilders, the equivalent of roughly $24, by the Walloon director-general Peter Minuit. At this time the city was hailed …

Investing for Young People Part 3: Differentiating Mutual Funds

By: Elias KellendonkPerhaps jumping into the stock market has turned out to be more of a chore than you and your child anticipated. If savings bonds and GICs are not offering the rates of return you and your child would like to see their savings yielding, mutual funds are a promising alternative. At current Canadians have well …

Investing for Young People Part 2: The Difference Between Stocks, Bonds and Mutual Funds

By: Elias KellendonkHow to Pick your Stocks Now that your child is proficiently handling their chequing account, making debits and deposits responsibly, and has assessed their risk tolerance, it is time to locate an investment vehicle that will see their savings dollars grow. While an allowance and monetary birthday/holiday gifts might line the accounts, authoress Katherine R. …

Investment Strategies for Young People

By: Elias KellendonkHelping Your Kids Get into Investing Early In this Internet-dominated, economy-fearing age it may be possible that your kids will out-know you in terms of stocks and trading before they finish grade school. American author Katherine R. Bateman suggests in her book, The Young Investor: Projects and Activities for Making Your Money Grow that no …

What is TFSA: Why Canadians should be Investing Tax-Free

By: Elias KellendonkHow will the Canada Tax Free Savings Account Guard your Retirement Funds? Registered or unregistered – that seems to be the question as Canadians plan and gear their savings and investment accounts toward retirement. Most experts advise that your investments gain a return in excess of two per cent in order to beat annual inflation. …

Stampede Buzz of Activity Could Mark Economic Recovery

By: Elias KellendonkLocal Businesses see Up-Surge of Corporate Spending Is it the enchantment cast by the recent visit of the Duke and Duchess, which sadly ends today, or an indication that the City of Calgary is enjoying better economic times? According to yesterday’s Calgary Herald, the answer lies in the latter. The Herald highlights the fact that …

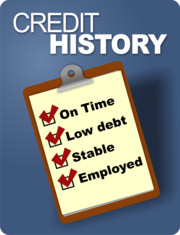

Improve Bad Credit in Six Easy Steps

By: Elias KellendonkCredit score is one of the major players in determining the amount of financing and interest rate you are eligible to receive. Credit history proves to lenders how reliable you are when granted funds. Leading up to your mortgage application, there are six, quite simple steps you can take to help improve your credit rating. …