Tag: home sales

House prices expected to drop in 2017

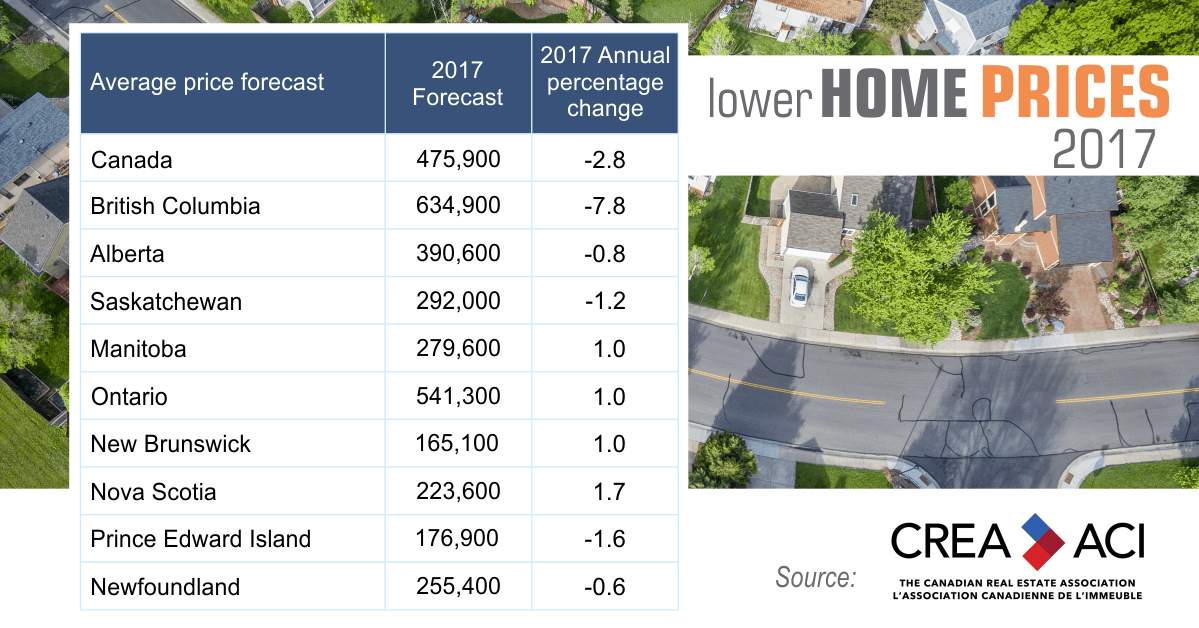

By: igillCanadian realtors are forecasting a price drop across Canada for the first time since 2008. They blame the new mortgage regulations brought in by the federal government in the last quarter of 2016.

Canada Housing Prices Predicted to Fall Up to 25%: Capital Economics

By: Elias KellendonkFirm Declares Property Values no longer Sustainable The independent research firm Capital Economics has warned Canadians that housing prices are on the verge of a weighty fall, as stated in an article that appeared yesterday in the Financial Post. The firm’s report announced that property prices have “lost touch with fundamentals”. Coupled with record household …