Super Brokers News

Protecting Yourself From Identity Theft is Common Sense

By: The Super BrokerEmail transmissions are not protected from hackers, phishers, thieves, and con artists; you should take multiple precautions to keep your identity protected.

Advantages of using a Mortgage Broker

By: igillMortgage Brokers are your personal shopper when it comes to mortgages. Brokers will have access to many lenders, each of them servicing a certain type of borrower. Brokers can present your application to the right lender, knowing which one will be a great fit. Using established relationships with lenders and presenting the file to them …

Saving for a Down Payment

By: Elias KellendonkAny down payment that totals less than 20 per cent of the property value will require mortgage default insurance, and be considered a high ratio loan.

Building the Right Team at Mortgage Time

By: Elias KellendonkA mortgage broker will help you ascertain the true amount you can afford to spend on your new home, before you start shopping.

Don't be Afraid to Talk to a Mortgage Broker

By: Elias KellendonkHalloween aside, this October has plenty of reasons to get you spooked, what with a recession, a long and tiring election campaign, and recent world events. Plenty of reasons, but your mortgage need not be one of them. We’re here to help in this frightful time, no matter if you’re buying a home, renewing your …

The Lender’s Equations: How Much Mortgage will you Qualify for?

By: Elias KellendonkLenders basically use two rules to determine the mortgage you are eligible to be funded to receive.

Happy Home Hunting Tips for Canadians

By: Elias KellendonkFinding the right home for you comes down to three chief factors: affordability, lifestyle, and your future needs.

Refinance and Consolidate Your Mortgage

By: The Super BrokerDebt consolidation or a Mortgage Refinance can cost effectively remove debt, and can make the financing of your future projects that much easier.

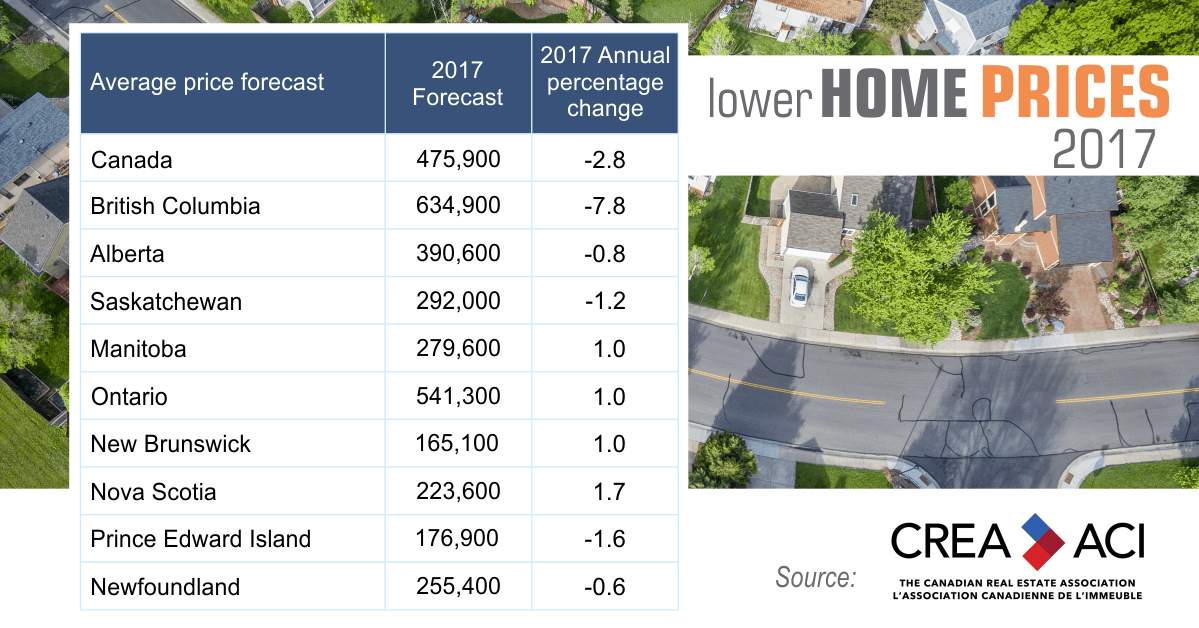

House prices expected to drop in 2017

By: igillCanadian realtors are forecasting a price drop across Canada for the first time since 2008. They blame the new mortgage regulations brought in by the federal government in the last quarter of 2016.

Longer amortizations…why do they cost more?

By: igillWith new regulations, insured mortgages have a maximum 25 year amortization. Banks often choose to insure low ratio mortgages, and cover the cost themselves. Having insured mortgages allows banks to off load the risk and securitize these mortgages.